HUNG THINH CORPORATION AND MEMBER UNITS: RESPONSIBILITY, PROACTIVE EXECUTION OF TAX POLICY

On October 12, 2020, the General Department of Taxation announced the List of 1000 largest corporate income tax payers in Vietnam in 2019 (referred to as V1000). In which, Hung Thinh Corporation and 3 member companies including Hung Thinh Land Joint Stock Company, Hung Thinh Incons Joint Stock Company and Khai Huy Quan Joint Stock Company were honored in the list.

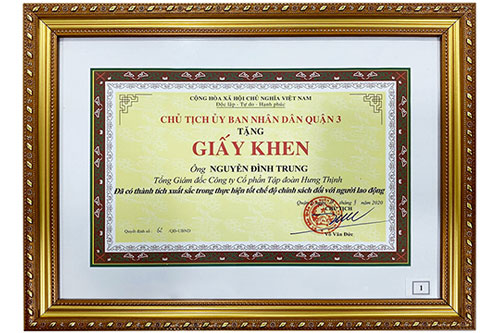

Along with business development activities, for many years, Hung Thinh Corporation and more than 80 member units have raised the sense of responsibility for implementing tax policies and law, complied with tax payment on time and in full. The responsibility and proactive execution of tax policy of the Corporation and many typical member units were recognized when being honored to be in the V1000 list, including: Hung Thinh Corporation (honored in 4 consecutive years), Hung Thinh Incons Joint Stock Company (honored in 3 consecutive years), Hung Thinh Land Joint Stock Company and Khai Huy Quan Joint Stock Company (honored in V1000 in 2019).

The amount of corporate income tax payment depends on the profits earned by the enterprise, indirectly demonstrating the efficiency of production and business of each company. Since the General Department of Taxation announced the V1000 list, Hung Thinh Corporation and many member units have been always listed in the V1000 Rankings, which proved the business performance, the continuous growth of the Corporation and the sense of responsibility for the development of the Country.